How can I make money in stocks? That question has been uttered billions of times, and still lingers as teens grow into adulthood. Stocks are the single greatest invention that have the ability to upgrade the life of someone from an economic disaster to pure financial freedom. It helps people break out of their social economic status, and climb to a higher socioeconomic class.

Is it risky? What isn’t? Time after time, people have tried to find new ways to make money in stocks while trying to reduce risk. The goal of any trade or investment is to reduce risk, but increase reward which in itself is counterintuitive. Why? because it’s known that risk is relative to reward! The lower the risk, the lower the reward. The higher the risk, the higher the reward.

After having been in the trading/investing world for almost 20 years, Its safe to say, you will learn more about the specific ways to make money in stocks within the next 5 minutes, then you would anywhere else. This will give you the strong foundation needed to understand the many ways you can use your money to make money through trading and investing in stocks.

Let’s start by listing the 5 main ways you can make money in stocks, then drill down deeper into each category

The 5 ways you can make money in stocks are:

1 – BUY LOW/SELL HIGH

2 – SHORTING

3 – DOLLAR COST AVERAGING (DCA) & DIVIDENDs

4 – LENDING & STOCK SPLITS

5 – STOCK PURCHASE PLAN (SPP) & INITIAL PUBLIC OFFERING (IPO)

1. Buy Low/Sell High

The concept of buying low and selling high is the most widely marketed money making technique in stocks. In the trading world, there’s many different ways of signifying that you’re buying low selling high. The 2 most common expressions are “going long” and “taking a bullish position”.

So how does one buy low and sell high? Say you’ve got $1000.00 that you’d like to make some money off. You would consider, study and evaluate different stocks i.e. company shares to decide which of these shares will appreciate in price.

Foundationally, it seems like a pretty simple concept. Wouldn’t someone just dump $10,000 to buy stocks in a business that operates worldwide, like an Amazon, Apple or McDonalds? Well, what if at the time you decide to buy, these stocks are heavily overvalued. You buy the stocks, and it instantly starts to plummet or experience a market correction. When this happens, you’re stuck either taking a loss when you sell, or tying your capital in a position that may take weeks, months or sometimes years to reverse course.

There are many different strategies involving fundamental and/or technical analysis that will educate you on what to buy, when to buy, and how long to be invested for.

Example

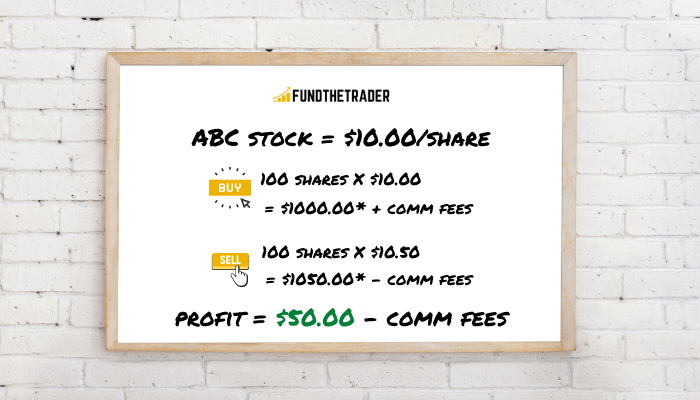

Market opens on Monday morning and company ABC is $10.00 a share. Hopefully, you’ve done your research and due diligence before jumping in, and you buy 100 shares. This costs you $1000.00 plus whatever the commission fee is associated with the trading broker you’re using. Towards the end of the trading day, the stock has gone up $0.50, and the price now is $10.50.

You sell the 100 shares you own at $10.50 giving you $1050.00 – commissions. Your net profit in a day was $50.00 – commissions. This is an example of buying low and selling high. Now if you had taken the same exact action, but instead had purchased 1000 shares, you would have made $500.00 in a day. This is specifically why plenty of people try to secure funding either through margin trading accounts or funded trader programs. Capital is one of the most important aspects of day trading if you decide on becoming a stock trader. If this is something you’d like to learn more on, we recommend you read how to become a funded trader.

How To Make Money In Stocks - Buy Low/Sell High

Can be executed in both short term trading or long term holding

2. Shorting

Shorting is an advanced money making technique used in stocks that is very risky. Shorting can also be referred to as “going short” and/or “taking a bearish position”. To short a stock is basically to bank on the fact that the stock will drop in price.

How do you short a stock? Very simple. You sell it before you buy it. Since shorting is a risky endeavor, not all trading brokerages provide you with ability to short.

The idea behind shorting is that you expect the stock to drop in value, so you’re taking a position that’s betting on that fact.

When I started trading, the concept of shorting was foreign. I didn’t even know it existed till 1 or 2 years into trading. Shorting means you’re borrowing stocks from someone else for the purposes to sell immediately at the current price, with the hope that the price for that stock will drop. Once it drops, you can rebuy it for a cheaper price and return the stocks to the lender.

This is how advanced traders profit from a bearish market. If you’re thinking wow, you can make money when stocks drop in price? Yes, but it’s really not as simple as you’d imagine. In fact, it’s harder to short than it is to buy low and sell high!

When you short, you basically lose money if the prices go up. You’re only profitable when the prices of stocks your shorting start going down. With shorting, there’s no stoppage to your losses. What do I mean? When you buy low/sell high, what’s the worst that can happen? The stocks you bought go to $0.00 and you lose every penny you invested. But when you’re shorting, the price of a stock can theoretically hit infinity, and your losses will not have an end in sight.

Example

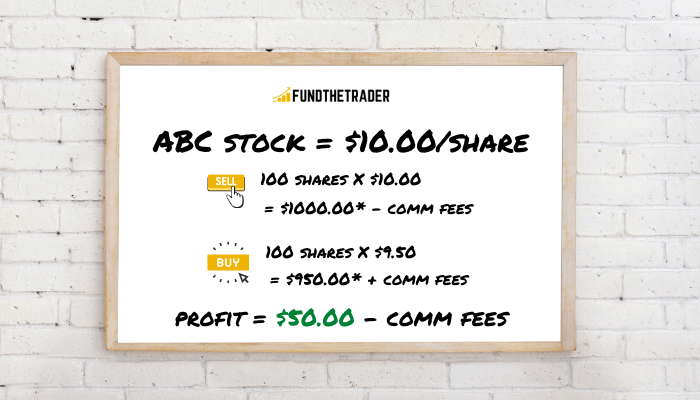

Jack makes a snap decision and decides that he’d like to short stock ABC. The stock is currently sitting at $10.00. He decides to “sell” 100 shares, and immediately receives $1000.00. The stock shortly thereafter drops to $9.50, and Jack buys back the stock to close out his position. The shares he bought back are theoretically returned back to the lender. He makes $0.50 cents off every share, which means he made a net profit of $50.00 – commissions.

How To Make Money In Stocks - Shorting

Risky trading style which would should be used by more seasoned traders

3. Dollar Cost Averaging & Dividend Reinvestment Plan

Dollar Cost Averaging (DCA)

Some of you may have already heard the acronym DCA. To those who haven’t, DCA stands for Dollar Cost Averaging. What is a DCA exactly? It’s a technique that can help you make money in stocks through recurring purchases into a specific position.

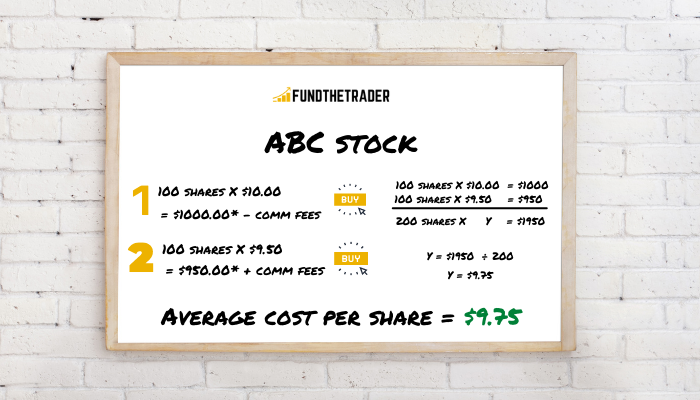

Day Trading

In this regard, a DCA can be employed by averaging up or averaging down. Let’s assume you buy 100 shares of stock ABC at a price point of $10.00 with the expectation that it’s bullish and will appreciate in price. However, contrary to your assumption, the price of the stock drops to $9.50. You buy another 100 shares at the new price point of $9.50. Doing so, drops your average cost per share to $9.75 instead of the initial cost of $10.00 per share. Other than the DCA, there are many strategies on how money can be made through stocks, but I encourage you to read 5 steps on how to become a better trader to strengthen your trading knowledge base.

Long Term Investing

A DCA can be extremely effective when combined with a long term strategy. How would you go about doing this? It’s really simple. First, decide how much you’d like to set aside for investing purposes. Second, decide how often you’d like to invest that money.

My suggested way to begin a DCA would be to set it up to recur on a weekly basis. Why? because pricing of stocks increase and decrease quite rapidly so by having a tighter time frame, you’re able to capitalize on the ups and downs.

When the stock price drops, your weekly investment buys more stocks. When the stock price increases, you buy less stocks, but who cares, your owned stocks appreciate in price making you money!

The most important factor to note is that you employ a DCA on solid blue chip large cap stocks, preferably ones that pay dividends.

How To Make Money In Stocks - Dollar Cost Averaging

A DCA can be used for both short term trading & long term investing

Dividends

Dividends are an incredible way to make money in stocks. Although there are ways you can benefit off dividends in the short run, a dividend strategy is generally employed in a long term passive strategy. So, What are dividends? Simply put, they are a portion of a corporation’s net profits paid out to shareholders.

These dividends are commonly paid out quarterly, but there are companies out there that pay out dividends on a monthly or yearly basis as well. Once you a buy shares in a company, you’re considered a shareholder of said company. When they make a profit and declare a dividend, you’ll be one of the recipients as long as you’ve held the shares before the ex-dividend date. If you buy shares on or after the ex-dividend date, you won’t be paid for the next dividend payout.

Day Trading

Sounds simple right? News flash it isn’t! If it was everyone would be doing just that daily. It still takes quite a bit of research and accurate timing to pull this off. Why? I’ll give you one main reason.

Every investor knows that dividends are about to get paid out, so they begin buying the shares a few days before the ex-dividend date, and prices of the shares start going higher because of higher demand. Once the ex-dividend date arrives, generally, the price of the shares start dramatically decreasing since everyone who bought the shares solely for the dividends are exiting their position.

Long Term Investing

Now that we’ve covered what dividends are as well as how you can make money off stocks through dividends on the short run, I’ll be introducing another concept, labelled as dividend reinvestment plan (DRIP) which oddly enough is not widely advertised to individual investors.

In Real Estate, you purchase an investment property for 2 reasons. It’s eventual price appreciation as well as it’s current monthly rental income. This is the analogy I like to cite whenever I explain the idea behind dividends to others. You can buy stocks, with the expectation of price appreciation, but while holding the shares, you can also collect dividend checks. If you’ve picked the right company to buy shares in, you’ll also notice that year over year, they’ll increase their declared dividend payout. This is another huge plus!

If we go one step further, we can reinvest these dividends back into the stock market. How does that work? Instead of the corporation paying out the dividends into your trading account, you can instead use the proceeds to buy more of that company’s shares.

Example

Company ABC was $50.00 a share.

John bought 100 shares of Company ABC on January 1st, 2020.

The dividend payout was $0.52 per share per quarter.

Since John was holding 100 shares, he was receiving $52.00 of dividends every there months. (100 shares X $0.52 = $52.00)

John had elected to go on the dividend reinvestment plan (DRIP) and by doing so, his $52.00 would be used to buy more shares of Company ABC.

After the first dividend, his holding rose to 101 shares

After the second dividend, his holding rose to 102 shares

After the third dividend, his holding rose to 103 shares

After the fourth dividend, his holding rose to 104 shares

In one year, without investing any more money John received 4 more shares.

Had the price gone down, then his dividend payout would have bought him more shares. If the price had gone up, well then he would have made money in stocks off of the appreciation.

How To Make Money In Stocks - Dividends

Dividends power is amplified in a long term passive investing strategy

4. Lending & Stocks Splits

Lending

Stock security lending is generally considered an advanced way to make money in stocks. The idea of lending stocks was born in the late 1960s, and matured into today’s vibrant and active lending practices seen today.

Lending is the concept that facilitates many types of trading activities, notably stock shorting. Without lending, shorting would not be possible. How does lending stocks work? The borrower and lender don’t really ever meet one another as everything is done through brokerage.

The borrower of the stocks are charged loan fees and various interest rates depending on the difficulty levels associated with borrowing that particular stock.

A stock is considered difficult to borrow when they’re supply is low (usually stocks that are illiquid)

Lending brokers generally create lists called easy to borrow (ETB) lists, to demonstrate which stocks are readily available should the borrower require it. When you make a decision to lend you’re stocks, your banking on the fact that the prices of the shares will rise in the long run. In the short run, you’re getting interest income, dividend income (in the form of manufactured dividend income) and/or broker fee rebates.

Stock Split

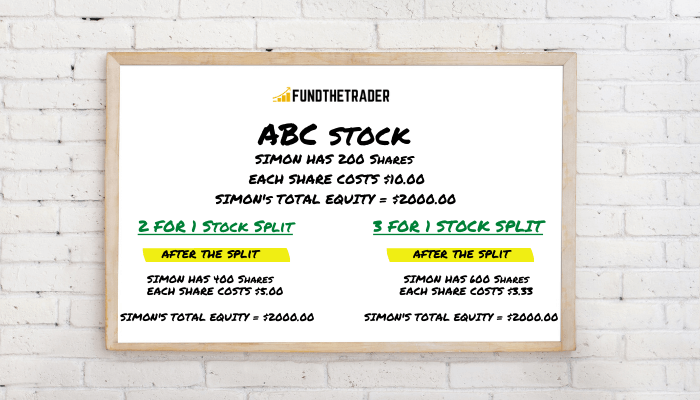

A stock splits by increasing the number of shares available while reducing price per each share. When this happens the market capitalization stays the same. Those that benefit most off of stock splitting are long term investors. Generally, when a stock is announced to be split, its considered to be positive.

There are many types of stock splits, but the most common ones are the 2 for 1, or 3 for 1 stock splits. What does this mean exactly? The 2 for 1 stock split basically awards an extra share for every share you already own. The caveat is that the price of each share halves.

Beginner day traders don’t really question why. Why does a stock split? Why is the price rising. I encourage you to think about the why’s in business. There could be a variety of reasons why a stock would split, but the most common reason is to generate interest amongst the masses. Management may feel that the stock price is too expensive, and would like to reduce pricing so that it’s more affordable and accessible to the average worker.

Example

Reverse Stock Split

As you can guess from the name, reverse stock splits, are exactly opposite to stock splits. Generally, the pricing of each shares increases, but the number of shares available decreases. The market capitalization of that stock, as usual remains the same.

Personally, I don’t like reverse stock splits. In fact, I’ve had pretty sour experiences with reverse stock splits. That’s not to say that, reverse stock splits, might not end up being profitable. BUT, I’ve learned to exit position once I hear of an upcoming reverse stock split. I’d rather wait and observe from afar.

How To Make Money In Stocks - Stock Splits

Stock splits have a more positive impact on share pricing whereas reverse stock splits generally result in having a negative outcome

5. STOCK PURCHASE PLAN & INITIAL PUBLIC OFFERING

STOCK PURCHASE PLAN (SPP)

Right off the bat, I’ll say that stock purchase plans wouldn’t really benefit day traders. It may help traders looking to save for 1 or more years.

I’d go as far as saying this sort of setup far outweighs traditional savings accounts. Yes, it’s risky, but there’s significant upside if the securities chosen have been studied extensively. Couple an SPP with a dividend reinvestment plan, and you’ve begun putting your money to work and generating passive income.

Stock Purchase Plans (SPP) can generally be broken down into 2 different categories.

Direct Stock Purchase Plan

Employee Stock Purchase Plan

Direct Stock Purchase Plan (DSPP)

Usually traders and investors buy shares from a reputable broker. The broker facilitates the purchasing of securities on their behalf for a fee known as commission. However, there are ways you can purchase stocks directly from the issuing company. What are the advantages of doing this? It may be possible to buy the securities at a discounted rate or even get charged lower fees.

The direct stock purchase plan can be combined with a dividend reinvestment plan for maximum long term gains. An example of a direct stock purchase plan would be Home Depot’s program

Employee Stock Purchase Plan (ESPP)

These type of plans grant employees the right to purchase stocks at the company they work for at either a deep discount or some form of stock matching plan.

Generally a pre-set amount is drawn off your pay check, and used to buy shares in the company. Depending on what the plan your company offers, this can be highly rewarding.

Employee stock purchase plans can be absolutely phenomenal or can be a complete disaster. The worst case scenario is that the company you work for goes bankrupt, you’re out of the job AND lose all the investment you’ve made into the company. That is the “Disaster” I was referring to.

On the flipside, this sort of program forces employees to save in the best possible way. If you’re on a matching plan, you’re essentially getting free shares. 50% of the shares you own, are bought by money you otherwise wouldn’t get. Basically, If the company loses 50% stock value, you still technically haven’t lost money.

How To Make Money In Stocks - Stock Purchase Plan

Both these plans can be incredibly rewarding for long term investors if the right company is chosen

INITIAL PUBLIC OFFERING (IPO)

Everyone has heard of IPO. It’s a buzz word people love to throw around. Ironically, ask them what it stands for, and they don’t know.

IPO’s are dangerous because the newly listed companies are brand new on the stock market, and have no historical charting or pricing.

Although underwriters cannot lend stocks for shorting purposes in the first 30 days, there is still a probability that the initial pricing for that share was grossly overestimated.

On the flipside, some IPO’s can be very rewarding. The price you buy for, you may never ever see again. Personally, I’d suggest only veteran traders buy and sell IPO’s in the short run. For long term investors, it may really pay off in a big way. Still, it’s risky and requires plenty of analysis.

How To Make Money In Stocks - Initial Public Offering

IPO's can pose as a quick way to make profits due to the high demand and fear of missing out. Traders should cautious when trading IPO's.

I’ve shown 5 ways that you can make money in stocks. What you have to consider is whether you want to be a short term day trader, or a long term stock investor. Based on the response, you can further your learning by understanding and executing a variety of different strategies.

I’ve given you a glimpse of how in depth the stock market can go. If you’re starting out as an investor, know that you’re just scratching the surface. There’s much much more! Good luck making money in stocks, and drop a comment if you feel this helped you!