Becoming a funded trader is no easy task. Let’s get that straight, right off the bat!

In my 20’s, I was on a mission to discover how one could make money aside from the generic road of graduating school and getting a job.

From the many “how to make money” & “get rich” books I read, I found trading capital markets most fascinating. The truth is that the markets have always been instrumental in accumulating wealth.

When I started trading with the little I had, I quickly learnt that day trading required a healthy funded trading account. Specially back when the trading commissions and fees were $30-$35 per trade.

In my article, 5 reasons why most traders fail, you’ll find one of the reasons that 90% fail is due to trading with insufficient capital. Don’t make that mistake!

If you’re looking to make a career out of day trading by earning a weekly/monthly stream of income, you’ll need at least $25,000.

Nowadays more and more people are living paycheck to paycheck, lacking the extra savings required to build up the needed capital to begin day trading. Wouldn’t you want to borrow money to day trade? Do you have the skills to get funded?

This leads us to discussing the concept of funded trading accounts, funded programs & prop trading firms.

Unlike many other articles I’ve read on this topic, I’ll do my utmost to dive deep and address the following frequently asked questions.

- WHAT IS A FUNDED TRADER, A PROP TRADER & A MARGIN TRADER

- WHAT IS THE DIFFERENCE BETWEEN FUNDED TRADING & MARGIN TRADING?

- WHAT ARE THE TYPES OF FUNDED TRADING ACCOUNTS?

- HOW TO GET A FUNDED TRADING ACCOUNT?

- WHAT ARE FUNDED PROGRAMS?

- WHAT ARE THE BENEFITS OF BECOMING A FUNDED TRADER?

- HOW MUCH DO FUNDED TRADERS MAKE?

- WHAT ARE THE BEST FUNDED TRADER PROGRAMS?

1. WHAT IS A FUNDED TRADER, A PROP TRADER AND A MARGIN TRADER

Funded Trader

Those in the business understand a funded trader to be an individual who has earned a fully funded trading account, and will be trading capital that belongs to a funding firm. These traders generally have their own successful trading formula and proven method. Using that method, they earn a funded trading account and go on to make a stream of income without risking their own capital.

There are 5 types of niche funded traders:

Forex Funded Trader

Stock Funded Trader

Futures Funded Trader

Options Funded Trader

Crypto Funded Trader

Depending on your expertise and experience in the markets, you have the choice to become a funded trader for one or more of these markets. Funded traders operate and are paid as independent contractors, which in a way means they’re self-employed for taxation purposes.

HIGHLIGHT

Full autonomy in trading style along with huge upside of potential earnings

Prop Trader

A prop trader is an individual, who similarly to a funded trader, also trades 100% of firms capital. They have no personal risk associated to the trades they execute.

However, the difference lies in the fact that prop traders are forced to use the trading strategies and techniques put in place by the prop firm.

They have controls in place to direct the prop trader, who essentially is paid, treated and taxed as an employee.

HIGHLIGHT

Entitled to a huge bonus if performing well without any fear of losing funded trading account

Margin Trader

A margin trader is an individual that is partially funded by a broker or a financial institution. They are also known as leveraged traders.

How does margin work? A margin trader needs to open a margin account at a financial institution/broker and deposit a sum of money.

Depending on the below listed factors, the broker will decide on how much margin to extend each trader

* Amount deposited by trader

* Traders credit rating

* Types of securities to be traded in the margin account

The financial institution will approve and extend a mini-loan known as margin.

This loaned amount is generally a leverage of 3 to 5 times the capital initially deposited by the trader.

HIGHLIGHT

No matter how poor the trading performance, percentage leverage extended remains intact

2. WHAT IS THE DIFFERENCE BETWEEN FUNDED TRADING AND MARGIN TRADING

It’s very important to understand the subtle differences in the concepts of funded trading and margin trading. My goal is to clearly highlight these differences to better equip you in choosing a trading style that would best suit you on your road to becoming a profitable day trader.

Funded Trading

Funded trading is the act of trading the markets without requiring any of your own capital to be committed. A prop firm or funded program entrusts you to trade their capital with the hopes that you’d be able to consistently be profitable and turn a profit. Unlike prop trading, this type of trading gives you autonomy on technique and strategy. Why? Because you’ve proven to the firm that you’re a profitable trader using your own secret formula.

HIGHLIGHT

Great opportunity to those who lack the capital, but believe they've got the necessary skills

Margin Trading

Margin trading is the act of trading the markets by committing a portion of your own capital. This facilitates a broker granting you access to what is essentially a mini-trading loan.

How much of your own capital required would depend on the broker or financial institution you’ve opened a margin account with.

HIGHLIGHT

A minimum capital investment is required to begin margin trading

3. WHAT ARE THE TYPES OF FUNDED TRADING ACCOUNTS

Forex Funded Trading Account

This type of funded trading account is awarded to those who prove themselves in the forex markets. In case you’re not aware, forex is an acronym for foreign exchange. The forex markets revolve around trading different currency pairs with the speculated expectation to benefit off future exchange rates.

Futures Funded Trading Account

This type of funded trading account is awarded to those who prove themselves in the futures markets. Futures are contracts that allow to buy or sell a commodity or asset in the future for a predetermined price. This type of funded trading account is popular because a little capital can go a long way to bring handsome profits.

Stock Funded Trading Account

This type of funded trading account is awarded to those who prove themselves in the stock markets. Stocks also known as equities provide the holder of the security a percentage of ownership in that corporation. There was a huge boom in stock traders during the COVID pandemic.

Other Funded Trading Account

Other types of accounts include the options funded trading account as well as the crypto funded trading account. Cryptocurrency has recently picked up a lot of steam gaining quite a bit of momentum. As of yet, there’s no funded program that extends 100% capital to trade crypto, but you may be able to access margin trading through crypto platforms and exchanges.

On the other hand, you may be able to find funded programs that offer options funded trading accounts.

4. HOW TO GET A FUNDED TRADING ACCOUNT

The road to getting a funded account is not a simple one. You’ll have many setbacks specially if you’re a beginner trader. Regardless, the best way to acquire a funded account would be to go through the following steps.

Step 1: Decide On The Market

Since there are multiple markets that you can trade, it would be wise to take the time and research which one you’d like to master. A few questions you can ask yourself to help with the decision making process.

Is there a particular market I have experience in?

When I watch the news, which markets intrigue me more?

When I discuss strategies with friends, which markets do I talk about?

If you’ve decided to become a fully funded trader, then my suggestion is to start by trading on either the futures, forex or stock markets.

DECISION POINT

Choose between forex, futures or stock funded trading accounts

Step 2: Decide Between Fully Funded Or Partially Funded

Depending on the choice you make, you’ll be looking at 2 different roads.

If you decide to become a fully funded trader, you’ll need to browse prop firms and funded programs. However, if you’re looking to become partially funded trader, you’ll need to look for a financial broker that facilitates day trading and provides margin accounts.

DECISION POINT

Choose between a fully funded trading account or a margin trading account

Step 3: Decide The Right Funding Partner

The time has come to dig deep and investigate further, trying to learn the details of the funding partners you’d likely be working with. Later in the text, I break down how funded programs work as well as list the best funded programs out there.

DECISION POINT

Investigate funding partner programs in depth to ensure they're reputable and have history

Step 4: Pull The Trigger And Get Started

Once all decisions have been made up to this point, go ahead and pull the trigger. Keep in mind that these 4 steps are surface guidelines on how you can get funded. But we’ll go deeper into step 3 by reviewing what funded programs are, and how they operate.

If you’d like to learn more, read on. If you’re ready to pick a funded program or broker right away, click on the respective button below that’ll allow you to browse an extensive list of these firms.

5. WHAT ARE FUNDED PROGRAMS

Funded Programs

Funded programs are educational programs that provide individuals with the training, tools and funding to become professional day traders. Prop firms are mostly the same, except that prop traders are considered more so as employees rather than independent contractors. Unlike prop firms, funded trader programs offer potential traders with the freedom to decide how many hours they’ll work, as well as what trading style they’ll use to turn a profit.

How Do Funded Programs Work

There are quite a few different funded programs out there, but most of them share the same foundational business model. When you join a funded program, you’ll need to prove to them that you have a consistent successful system in place to turn a profit. How do you do that? They ask you to subscribe and either pay a monthly recurring fee or a one time fee to trade on their real-time simulation.

No matter the market, funded programs generally have 3 steps. the first step would be to get your trading evaluated through a simulation. Once your able to show some consistency, they’ll have other goals in place to check whether you can manage risk. If you accomplish that, they’ll fund you.

Sounds simple right? It’s not. The first thing I mentioned was 90% of traders fail. What does this mean? It means that 90% of subscribers who are paying monthly fees will more than likely fail in receiving funding. Is it because it’s a scam? No. I’ve personally worked at a funding firm. Those who passed were genuinely funded.

The funded programs will not stop you from trying and trying. It’s up to you whether you want to quit or keep going. Generally, people get disheartened and give up, then there are those who are passionate and want to succeed at all costs.

The expression “If you don’t quit, you won’t fail” applies here.

Personally, even if you do quit, I still see it as a win. Why? A few reasons.

1) You learnt the concepts of capital markets, day trading and different financial instruments which you can use towards your long term investing goals

2) Since you were trading in a simulation, you’re not actually losing tens of thousands of dollars if you fail, instead you only lose the subscription fees.

Had you traded with your own capital, imagine how much you would have lost!

3) You find out what people pay to realize. What’s that? Day trading isn’t for you.

On the flip side, if you meet the funded program goals, you’ve got an opportunity to change your life situation drastically by becoming a professional funded trader.

How Do Funded Programs Make Money

Firms offering funded programs primarily make money in 2 ways.

The first way is by charging fees to potential traders looking to get funded. The second way is the percentage they keep from the profit sharing split agreed upon with their funded traders.

Given that 90% of traders fail, it’s logical to assume that 90% of all fees paid would contribute towards the majority of their profits. However, that’s not a totally accurate depiction if you consider the power of just how much money one of their funded traders can profit in a month.

I’ve seen many reviews bashing funded programs, but none that logically weigh the scales from the firms perspective. Since I’ve worked at a funding firm, I know that there are plenty of costs associated to running this service.

Only because 90% of traders aren’t funded doesn’t mean they don’t require customer service while they’re trading on a simulation. It doesn’t mean they don’t require coaching or training.

Have you considered their costs to run a funding service?

What about their employees cost? Their tech cost? Their marketing cost? What about funded traders burning through their total max loss on the first or second day of becoming a funded trader? I guess those who bash don’t think about it from that perspective.

Ultimately, what covers all these costs? Part of the fees collected to remain profitable and continue to provide funding to those who are able to succeed.

HIGHLIGHT

Funded programs profit through a profit sharing split with funded traders as well as fees collected from those looking to get funded

Funded Program Fees

There are different ways that these programs charge prospective clients. You want to pay special attention and learn more about each of the fees by reading their frequently asked questions.

Often times, the fees are listed but due to the excitement, beginner traders jump in without clearly understanding. On the other hand, funded programs may at times not clearly communicate the fees. It’s up to you to investigate and learn whether that’s done deceptively or innocently.

Subscription Fees

Almost all of the funded programs charge either a recurring or a one time subscription fee to their market simulation software. What’s included in these fees vary from program to program, but it’s up to you dig through and understand which of these offer the specific value you’re looking for.

Platform Fees

Some funded programs force you to use their trading platforms. Others offer to sync up with more popular 3rd party platforms. Generally, when you use their signature platform, they don’t charge fees. It’s not necessarily a rule, but when you opt to use 3rd party platforms, you may be hit with extra platform fees. Once again, read their FAQ clearly and make a decision as to how you’ll move forward on that front.

Exchange Fees

Some funded programs force you to use their trading platforms. Others offer to sync up with more popular 3rd party platforms. Generally, when you use their signature platform, they don’t charge fees. It’s not necessarily a rule, but when you opt to use 3rd party platforms, you may be hit with extra platform fees. It’s important to note that market exchange fees may change depending on whether you’re in the evaluation phase or the funded phase. Once again, read their FAQ clearly and make a decision as to how you’ll move forward on that front.

Resets

What are these you’re asking yourself? During the evaluation phase, you’ll have rules to abide by. If these rules are broken, you may need what’s called a Reset. These resets are basically fees for you to continue the evaluation. They’re put in place to avoid individuals carelessly trying to reach the goals without any care of the rules. The whole point of these programs is to train you in being a consistent profitable trader. They don’t want luck in the mix.

HIGHLIGHT

Before jumping into a program, educate yourself on the fees by visiting their FAQ section

Funded Program Rules

In order to pass an evaluation period, you must be able to hit a certain target while maintaining the rules. These rules differ from funding firm to funding firm, but are generally stringent in nature. If you’re wondering why some rules are pretty tough, then ask yourself what sort of rules you’d enforce before committing at least $50,000 to someone you don’t know. Funding is no joke, and carries with it a huge amount of risk. In order to decrease the risk, but still offer an opportunity, these funded programs create certain rules that need to be followed before traders are funded.

Depending on which funded program you’ll choose, there may be 2 sets of rules. One set of rules for the evaluation period, and another set of rules for the funded trading stage. Some traders may find rules from one program easier to follow, whereas other traders find it difficult. If you’re not a beginner, your trading system might help you choose which funded program suits you best.

HIGHLIGHT

Understanding the rules of the funded program are of the utmost importance, and may be the biggest reason that'll either make you or break you

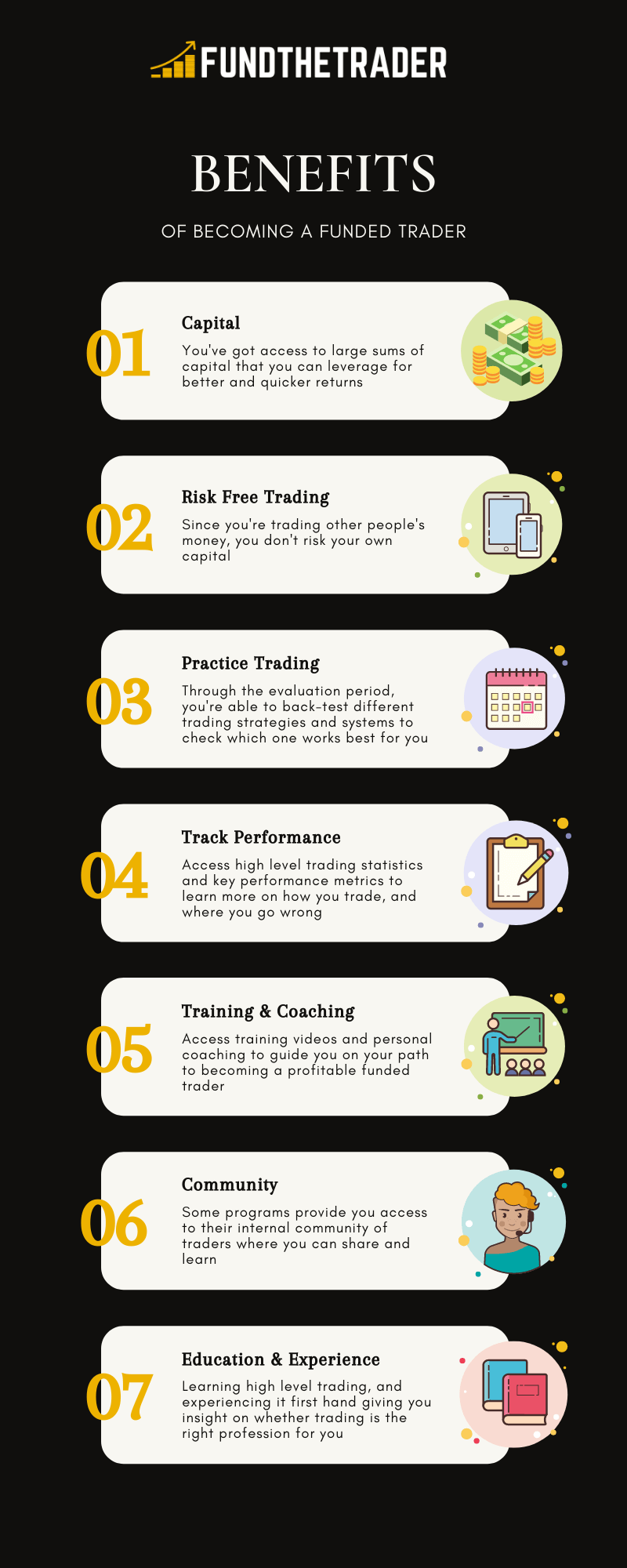

6. WHAT ARE THE BENEFITS OF BECOMING A FUNDED TRADER

7. HOW MUCH DO FUNDED TRADERS MAKE

This is a very popular question. One, that most beginners love to ask, because they’re excited about the prospect of making heap loads of cash from day trading. My advice, don’t dwell on how much you can make. First, find out whether you’ve got what it takes to become a fully funded day trader.

For sake of the below illustration, let’s assume you’ve got what it takes.

You begin trading and make a conservative return of 3% per month. If you’re trading with a $100,000 funded account, then your gross return is approximately $3000.00 per month. Let’s also assume that your profit sharing split with the funding firm requires for you to give them 50% of all your profits. With those calculations, you’ll be netting about $1500.00 per month. Sounds insignificant right?

Keep in mind in the above example, I’ve given very conservative returns along with a pretty poor profit sharing split.

Imagine what the possibilities could be if your returns on average are 6%-10%. On top of that, consider that the profit sharing split plan that you’re on gives you 75% of the profits.

With those types of numbers, you’re looking at $7500.00/month.

Now, let’s push the envelope and assume you’ve qualified for a funded account of $250,000 or $500,000. Sky is the limit.

HIGHLIGHT

Strive to work with a funding firm that gives a fair profit sharing split, as well as the ability to grow your funded account should you want to

8. WHAT ARE THE BEST FUNDED TRADER PROGRAMS

The word “best” is subjective. Your goal should be to connect and work with a funded program that checks off all the points you deem important. On our funded trader programs page, you’ll find an extensive list of funded programs that you can browse through. However, I’ll point out the 3 of the most popular funded programs.

Top Step Trader

One of the first and fastest growing funding firms based out of Chicago. Top step offers funding for both the futures and forex markets. It’s subscription fees are relatively low in comparison to the value you receive. One of the biggest selling points of Top Step is their customer service. It is really second to none!

Earn2Trade

Another popular funding firm that’s been around for quite some time with an office in Wyoming. Earn2trade’s educational content really helps traders learn more about the futures market. It’s a reputable company with strong history.

OneUp Trader

OneUp trader has also been around for quite some time. This firm provides clear steps on how to get funded as well as a 14 day free trial to give prospective traders an idea of how the program works.

Once you’ve picked a funded program and have begun your journey, I suggest you read the article 5 steps on how to become a better trader . Through there you’ll be able to find strategies that will up your chances of succeeding and getting funded.

DISCLAIMER: This blog should in no way be confused for financial advice.

This is for information purposes only.

It is not intended to be financial advice, nor should it be taken as such.

Please consult a financial advisor for your specific situation.

2 Comments

Oh my goodness! Amazing article dude! Thanks, However I am going through issues with your RSS. I don’t understand the reason why I can’t subscribe to it. Is there anyone else getting identical RSS problems? Anybody who knows the answer will you kindly respond? Thanks!!|

Glad you found it informative & resourceful!

Reach out to us directly if you’re still having problems subscribing,

Thank you Nathanial