Trading is a profession that encompasses individuality and personality, which is why you have to understand and discover the type of trading you’re most comfortable with.

If you’ve ever dealt with a financial advisor, you’d know one of the processes they must complete is “KYC” – Know Your Client. This allows the advisor to learn about their prospect’s risk tolerance and future goals.

It’s no different when you make a solid decision to trade and risk your own money in the markets. Trading psychology is the area of study that deals with day-trader behaviour and mindset. You must learn your own risk limitations as well as clearly define what your goals are with trading.

The more you understand about risk tolerance and what drives you, the better of a trader you can potentially become. There are many ways to categorize types of traders but the most popular trading styles are based on market timing

There is a direct correlation between risk tolerance and time length of trades or investments. Contrary to popular opinion, the reality is the shorter the time your money is in a position and exposed in the markets, the less risk exposure you assume.

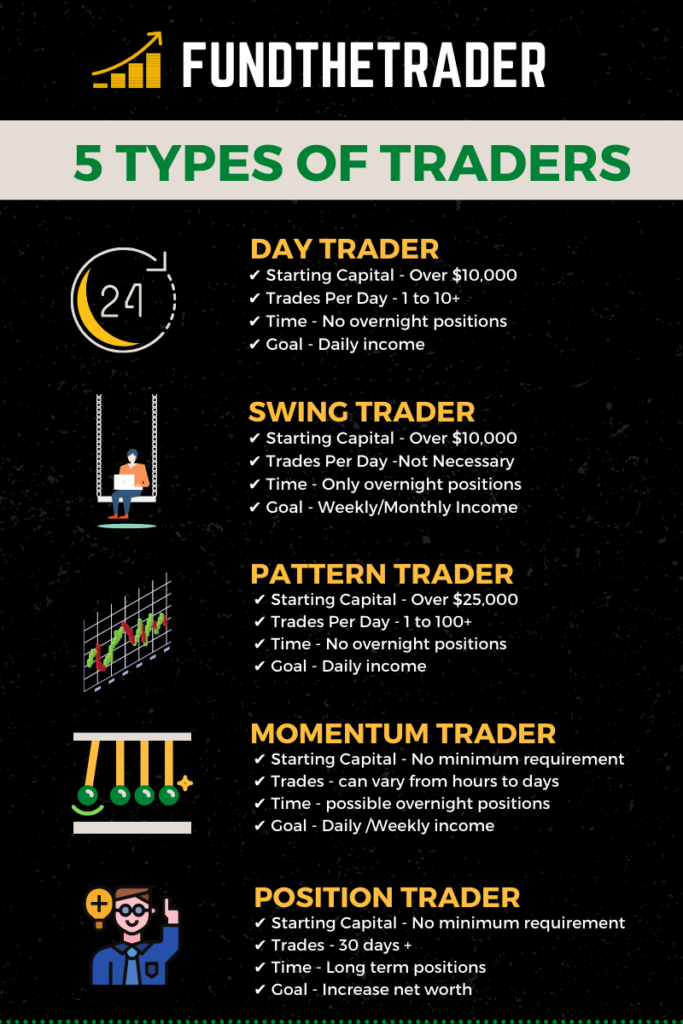

Based on that, we list out and describe the 5 main types of traders:

Type #1 – Day Trader

Type #2 – Swing Trader

Type #3 – Pattern Trader (Scalper)

Type #4 – Momentum Trader

Type #5 – Position Trader

1. TYPE OF TRADER | DAY TRADING

Market Timing & Trade Volume

A day trader is an individual who buys and sells securities on the same day. These types of traders don’t hold any overnight positions, and take advantage of intraday securities price fluctuation. The number of round trades usually executed by day traders would vary between 1 & 10.

Strategy & Analysis

Day traders may employ a variety of strategies that are more likely based on technical analysis rather than relying on fundamental performance. The ideal situation for a day trader would be to get in and out of a position once per day while meeting the short-term financial goals they’ve set. A day trader should constantly monitor the markets and have an eye on their positions.

Capital Requirements

Day traders should have adequate capital to trade with. If you’ve got anything below $10,000.00, you’ve got 2 options.

Option 1: Start trading using other trading styles

Option 2: Get funded through prop firms

Source of Income

Is it possible to day trade while having a 9 to 5 job? Theoretically, sure it is. Practically, it would either negatively impact your occupation or you won’t be an efficient trader, and risk losing money in the markets.

This sort of trading is more for someone who’s looking for daily stream of income.

ASSESSMENT | Are you a day trader?

✔ Starting Capital - Over $10,000

✔ Trades Per Day - 1 to 10

✔ Time - No overnight positions

✔ Goal - Daily income

2. TYPE OF TRADER | SWING TRADING

Market Timing & Trade Volume

A swing trader is an individual who buys and sells securities in a time frame typically longer than a day trader. Positions are held ranging between a few days up to a few weeks. These types of traders commonly hold overnight positions and take advantage of short-term trend changes affecting price.

Strategy & Analysis

Like day traders, swing traders also take in consideration the technical analysis of a security. However, unlike a day trader, successful swing traders should have an idea of the stocks underlying fundamental performance.

Why? When you’ve got your money tied up in a company’s equity for days or weeks, wouldn’t you want to know the financial situation of that company? If you don’t, then you’re assuming an added level of unnecessary risk to an already risky proposition.

The ideal situation for a swing trader would be to get familiar with the behaviour of a security. The ability to multi-task would go a long way in analyzing different sectors at one time. By consistently monitoring that stocks highs and lows in a given time range, a swing trader would be much more effective in generating profits.

Capital Requirements

An advantage swing traders have is that they don’t need a large starting capital to effectively swing trade. Since you are in a position for a longer period of time, you will probably have access to higher percentage returns on your positions. For that reason, you’d be able to begin swing trading with $100. It should go without saying that if you are swing trading with low capital, you’d have to find a discount broker that either has low fees or no commission fees at all.

Source of Income

A swing trader examines and studies the security they’re planning on taking a position in. Since they enter into a position with a mindset to hold for multiple days/weeks, the swing trader could take a more relaxed approach to monitoring the markets. They would also have a higher probability of success in balancing a 9 to 5 job and trading.

ASSESSMENT | Are you a swing trader?

✔ Starting Capital - Over $100

✔ Trades Per Day - Not necessary

✔ Time - Only overnight positions

✔ Goal - Weekly/Monthly income

3. TYPE OF TRADER | PATTERN TRADING/SCALPER

Market Timing & Trade Volume

A pattern trader, also known as a scalper, is an individual who buys and sells securities that spans at most a few minutes. Not only do these traders not hold any overnight positions, they barely hold positions spanning longer than 10 minutes.

Scalpers take advantage of micro-price fluctuations. The number of round trades usually executed by pattern traders can vary drastically. Most execute trades anywhere from 10 to 100 round trades per day.

Sounds crazy right? The below example illustrates the power of a scalper when equipped with the right platform.

Example: Scalper buys 10,000 shares of Company ABC at $2.21 a pop. one minute later he sells 10,000 shares at $2.24 a pop.

Sell 10,000 shares X $2.24 = $22,400.00

Buy 10,000 shares X $2.21 = $22,100.00

Gross Profit: $300.00 (in just a minute)

The above example is a real life scenario. How do I know? I’m the one who executed that trade.

Strategy & Analysis

Scalpers trade solely off technical data specifically buying and selling securities using a 1 to 5 minute chart analysis. This type of trading is very advanced and requires a significant amount of discipline. The ideal situation for a pattern trader would be to have the sum of their trades net positive at market closure.

Capital Requirements

Pattern traders using margin accounts require a minimum of $25,000 capital to trade with. Why? For one, The PDT Rule (Pattern Day Trader Rule). A second and more important reason to have at least $25,000 capital is for efficiency purposes. If you’re looking to reap profits from penny movements, then larger-funded accounts are required.

Source of Income

This form of trading is a full time job. Those who are looking to become pattern day traders must not have any other occupation at least from 9:30am to 4:00pm EST. Being a scalper produces a daily stream of income similar to day trading.

ASSESSMENT | Are you a SCALPER?

✔ Starting Capital - Over $25,000

✔ Trades Per Day - 1 to 100+

✔ Time - No overnight positions

✔ Goal - Daily income

4. TYPE OF TRADER | MOMENTUM TRADING

Market Timing & Trade Volume

A momentum trader is an individual who buys and sells based off the breaking out technique. These type of traders can hold positions that vary greatly. The positions can span between a few hours to a few weeks depending on how strong the momentum is.

Strategy & Analysis

Momentum traders are searching for securities that have an upcoming activator. Some examples of what I like to call “activators” can come in the form of news, volume, hype, or even a short-term price correction. Momentum positions pick up and lose steam quite quickly.

It’s important that a momentum trader monitor their positions closely and frequently. The ideal situation for this type of trader would be to enter a position pre-activator; the more vicious the momentum, the more likely profits will soar.

Capital Requirements

These type of traders don’t really require a minimum capital. They’re banking off vigorous and sudden price changes once they enter a position. 10%-50% returns in a momentum trade is very likely, but can also work against you if you’re not careful.

If you’re concerned about starting capital, look into and learn more about momentum trading. It might be a good starting point for you as a novice or underfunded trader.

Source of Income

Trying to spot a momentum trade on a daily basis is not an easy task. Yes, its true that these types of traders can make a profit within a day. But its far more likely that they produce profits over weeks. Having said that, not having another primary source of income might not be the best idea if you’re this type of trader.

ASSESSMENT | Are you a momentum trader?

✔ Starting Capital - No minimum requirement

✔ Trades - Can vary from hours to days

✔ Time - Possible overnight positions

✔ Goal - Daily/Weekly income

5. TYPE OF TRADER | POSITION TRADING

Market Timing & Trade Volume

A position trader is an individual considered to be a longer term buyer and seller of securities. This form of trading involves holding over a longer term horizon disregarding the short-term price fluctuations the security experiences.

These type of traders always hold overnight positions, and take comfort in knowing their holdings will appreciate over time. They’re generally less concerned about trading commission fees and focus more on the fundamental research provide by their brokers.

Strategy & Analysis

You, as a position trader, almost never care about the technical analysis of a security. Your sole focus should rather be concentrated on fundamentals, foreign politics or economic policy depending on type of securities you’re trading.

Based on the trading style, it’s safe to say that the only time a position trader enters and exits a position is exclusively correlated with their long term outlook on that security.

Capital Requirements

I began my journey into the financial world using a position trading approach. Why? I wasn’t just short of capital, I didn’t have any! This trading style can afford novice traders “time”, and doesn’t generally require a fast paced rhythm. I believe it to be a good starting point to familiarize yourself with trading terminology and the financial markets.

Source of Income

This type of trader would definitely need to have an alternate source of income.

ASSESSMENT | Are you a position trader?

✔ Starting Capital - No minimum requirement

✔ Trades - 30 days +

✔ Time - Long term positions

✔ Goal - Increase net worth

The key takeaway is that trading requires an introspective approach. Take the time to honestly and sincerely critique yourself.

Start off by asking yourself the following questions:

1) What’s my risk tolerance?

2) Do I truly understand the value of the dollar?

3) What do I expect to get out of trading?

4) What sort of capital would I trade with?

5) What amount of time can I dedicate towards trading?

The answers to these questions will give you a glimpse of what kind of trading style would suit you. It will also put you on the path to learning as to what type of trader you truly are.

DISCLAIMER: This blog should in no way be confused for financial advice.

This is for information purposes only.

It is not intended to be financial advice, nor should it be taken as such.

Please consult a financial advisor for your specific situation.